Military Insurance Commercial - On the other hand, VGLI can become more expensive as you get older. Unlike SGLI, VGLI premiums are based on your age and increase significantly with age. Many people feel that they have to reduce their coverage as they get older in order to afford the premium.

Yes, absolutely. First you need to find an online business insurance provider like Next Insurance. It then allows you to buy a policy instantly and your cover will be activated within 48 hours. While USAA and GEICO are the most affordable insurance companies for service members and their families, they are not the only companies that offer military benefits.

Military Insurance Commercial

Source: www.atlasair.com

Source: www.atlasair.com

While Nerd Wallet Insurance does not offer a military discount, it does allow deployed customers to cancel their policies for the duration of their deployment. When they return from deployment, they can renew their insurance at the same rates.

Cons Of Vgli

This policy feature saves military members money while helping them protect their insurance history. The company offers military life insurance policies for as little as $12 a month, which include wartime coverage and up to $25,000 in critical injury assistance.

Policyholders can retain this feature of the provided cover after they leave. These policies are available in 10, 15, 20, 25 or 30 year increments and can be upgraded to Whole Life and Universal Life. USAA makes it possible for retired military members to receive active duty bonuses as soon as they replace SGLI – even for disabled retirees.

Military car insurance is an insurance policy designed for active military personnel and veterans. As NerdWallet points out, these demographics often have different insurance needs than the general population. Many auto insurance quotes offer service members and veterans special rates and discounts not available to other customers.

Founded in 1957, MBA offers 10- and 20-year term life insurance to veterans as an option or supplement to existing VGLI coverage. Company life insurance policies are issued by MetLife, Inc. They are written that received an A+ rating from AM Best.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com

Can I Buy Business Insurance Online For My Military Surplus Store?

As an added benefit for older veterans, MBA offers a supplemental life insurance plan that provides coverage up to age 90. Example 2: While trying on a custom-made work jacket for a customer, an employee makes a mistake in recording the measurements.

If a garment causes financial loss or damage during use, general liability will help cover any costs associated with the defect. Clicking "Continue" will take you to a website owned by GECO. GEICO has no control over its privacy practices and assumes no responsibility for the use of the Site.

Any information you provide directly to them is subject to the privacy policy posted on their website. You can also apply for the policy through the company's mobile app, the process takes about 20 minutes. At that time, a free medical examination is required, which will be arranged at your convenience.

This meeting can be held at your home or at a location of your choice. Within two weeks, USAA will review your eligibility and determine your award. Until 2019, military retirees were eligible for Tricare Dental.

Esurance For Military Members

But that changed, and the military switched retirees to the Federal Employees Dental and Vision Insurance Program, or simply FEDVIP Dental. Available: Maximum coverage is $400,000 and is available in $50,000 increments. Once you leave service, you will continue to be covered at no charge for up to 120 days after the date of separation.

Advertising Notice: Military Wallet and Three Creeks Media, its parent companies and affiliates, may receive compensation for placing advertising on Military Wallet. For any rankings or listings on this site, Military Wallet may receive compensation from rated companies, and that compensation may affect how, where, and in what order products and companies appear in the rankings and listings.

Source: cdn.everquote.com

Source: cdn.everquote.com

If the rating or listing states that a company is a “partner,” the recommended company is the Military Purse Corporation. No table, classification or list is exhaustive and does not include all companies or products available.

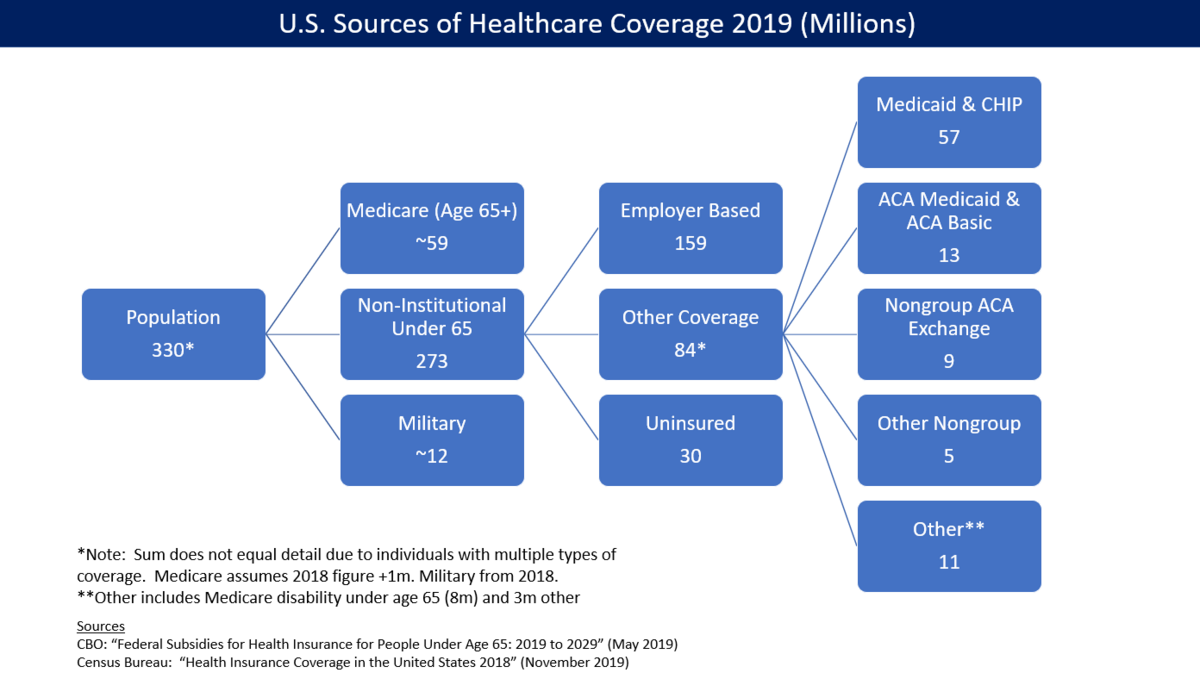

You must participate and pay premiums for Medicare Part B. Tricare For Life covers medical expenses after Medicare. There is no annual or monthly subscription fee for the program. Treatment must be performed in the US or US territories.

Fedvip Dental

Although a military surplus store is not legally required to accept general liability, operating without one is extremely dangerous. If your military surplus store gets sued, you could face hundreds of thousands of dollars (or more) in charges.

TriCare for Life is a statutory supplemental health insurance program for retirees and their spouses over the age of 65. To use TriCare for Life, retirees must also enroll in Medicare Part B and pay a monthly Part B premium.

Life insurance companies for veterans often include optional coverage for children and spouses. Some, like the AAFMAA, offer coverage for qualifying grandchildren. Some offer preferred rates (or reduced monthly premiums) to those with healthy lifestyles. Many even pay benefits for war-related deaths.

Quick online quotes are available on the company's website. Interested customers can call the company to speak with a sales representative Monday through Thursday from 8:00 a.m. to 7:00 p.m. EST and Fridays from 8:00 a.m. to 4:00 p.m. EST Rated A++ (Superior) by AM Best, USAA has been in business since 1922 and offers a variety of life insurance policies for active duty military and veterans, including term, whole and universal life.It gives.

Source: upload.wikimedia.org

Source: upload.wikimedia.org

What Is Tricare For Life?

Catastrophic caps are similar to Tricare Prime. For active family members, it is $1,000 for Group A members and $1,120 for Group B members. For retirees, their families and others, coverage is $3,706 for Group A members and $3,921 for Group B members.

Members of the Ready Reserve or National Guard in an unpaid status may still be covered by SGLI if they are expected to complete at least 12 inactive training sessions per year and are earning points instead of pay.

Veterans Group Life Insurance (VGLI) allows you to continue your military life insurance after you are separated from the service. It provides lifetime coverage as long as you make premium payments. Most importantly, you don't need to provide proof of good health.

Business interruption insurance can help cover any loss of revenue if your military surplus store has to close for an extended period of time due to a natural disaster or severe destruction. If you operate your business in an old building or live in an area prone to inclement weather, this insurance can be critical to keeping your business afloat if you have to close for several weeks.

Veterans Group Life Insurance Vgli

There are many ways military members, veterans and their families can save money on auto insurance. If you want quality car insurance at an affordable price, Zebra recommends the following steps. Even better, the military can't take away your SGLI policy if something changes in your health or medical condition.

You can usually increase your coverage up to the limit without any problems, but if something changes in your health, you may need to get it approved. Therefore, it is important to take this into account when setting coverage limits.

Looking for your next challenge after military service? GEICO offers a variety of career opportunities through our network of headquarters and local offices. And we offer many opportunities to add to your ever-changing skill set. The Department of Veterans Affairs offers SGLI to active duty personnel.

There is also VGLI coverage up to $400,000 and Service Disabled Veterans Life Insurance (S-DVI) for those who meet certain eligibility requirements, including meeting application deadlines. Ryan Gina is the founder of Soldier Bag. He is a writer, small business owner and entrepreneur.

Business Interruption Insurance

He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard. TriCare Young Adult is available in Prime and Select versions and is open to full-time students ages 23-25 or non-student military members ages 21-25.

. "Business insurance" is a general term used to describe the many types of insurance that a business may need. On the other hand, general liability insurance is a special type of coverage that business owners need to protect their property.

This cover is available to you if your employees are negligent or make mistakes while on the job. For example, if you fail to communicate important information to a customer about leftover products they purchase, this insurance can help cover the costs of a liability claim.

These answers are not provided or provided by the promoter of the Bank. Answers have not been reviewed, approved or otherwise approved by the Bank Promoter. The Bank is not responsible for responding to all messages and/or questions.

Source: 2.bp.blogspot.com

Source: 2.bp.blogspot.com

How Active Military Members And Veterans Can Save On Car Insurance

Civilian dental care is covered if you receive a referral from a military dental clinic or live in a remote location without a military dental clinic. There are no out-of-pocket costs for covered dental services. This is a fixed premium group life insurance policy.

This means that the premiums are the same for everyone, regardless of age, health status, medical condition or other factors. It only changes when your premium changes for everyone else. The company has a USBA Double Value Two per family group level term life plan first death policy.

It provides equal cover for married couples with a single monthly premium and pays after the death of the first spouse. This is an attractive option for veterans and their families looking to stretch their budget.

Monthly premiums for $150,000 are $15.75 for non-smokers ages 31-40 and $51 for non-smokers ages 51-55. Dependent children may add an additional $1.50 per month per child only. The TRICARE Dental Program is a voluntary dental plan available to members of the National Guard or Reserve who are not on active duty and are not covered by the Transitional Assistance Administration Program (TAMP).

What Is Tricare Young Adult?

This also applies to family members of the service member.

commercial building insurance, commercial business insurance, cheap commercial insurance, commercial property insurance, military life insurance, military insurance benefits

0 Comments